Difference between revisions of "Documentation/How Tos/Calc: DDB function"

From Apache OpenOffice Wiki

< Documentation | How Tos

(Issues) |

m |

||

| (13 intermediate revisions by 5 users not shown) | |||

| Line 1: | Line 1: | ||

| − | __NOTOC__ | + | {{DISPLAYTITLE: DDB function}} |

| + | {{Documentation/CalcFunc FinancialTOC | ||

| + | |ShowPrevNext=block | ||

| + | |PrevPage=Documentation/How_Tos/Calc:_DB_function | ||

| + | |NextPage=Documentation/How_Tos/Calc:_SLN_function | ||

| + | }}__NOTOC__ | ||

== DDB == | == DDB == | ||

| Line 21: | Line 26: | ||

=== Example: === | === Example: === | ||

| + | [[Image:Calc_ddb_graph1.png|left]] | ||

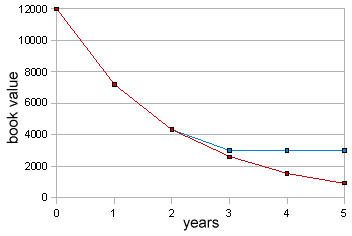

<tt>'''DDB(12000; 3000; 5; 1)'''</tt> | <tt>'''DDB(12000; 3000; 5; 1)'''</tt> | ||

: returns <tt>'''4800'''</tt> in currency units. The rate is 2/5, or 40%. The book value at the start of year 1 is 12000, and 40% of 12000 is 4800. | : returns <tt>'''4800'''</tt> in currency units. The rate is 2/5, or 40%. The book value at the start of year 1 is 12000, and 40% of 12000 is 4800. | ||

| Line 32: | Line 38: | ||

<tt>'''DDB(12000; 3000; 5; 4)'''</tt> | <tt>'''DDB(12000; 3000; 5; 4)'''</tt> | ||

: returns <tt>'''0'''</tt> in currency units. The book value at the start of year 4 is equal to the salvage value; no further depreciation is possible. | : returns <tt>'''0'''</tt> in currency units. The book value at the start of year 4 is equal to the salvage value; no further depreciation is possible. | ||

| + | <br style="clear:both;" /> | ||

| − | === | + | === Issues: === |

| − | + | * Note that this method may not depreciate the asset fully to its salvage value. For example, <tt>'''DDB(1000; 0; 3; 1) + DDB(1000; 0; 3; 2) + DDB(1000; 0; 3; 3)'''</tt> = <tt>'''962.96'''</tt>, leaving a residual value of <tt>'''37.04'''</tt> instead of <tt>'''0'''</tt>. The <tt>'''VDB'''</tt> function is an alternative which overcomes this. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | |||

| − | [[Documentation/How_Tos/Calc: | + | {{SeeAlso|EN| |

| + | * [[Documentation/How_Tos/Calc: DB function|DB]] | ||

| + | * [[Documentation/How_Tos/Calc: SLN function|SLN]] | ||

| + | * [[Documentation/How_Tos/Calc: SYD function|SYD]] | ||

| + | * [[Documentation/How_Tos/Calc: VDB function|VDB]] | ||

| − | + | * [[Documentation/How_Tos/Calc: Derivation of Financial Formulas|Derivation of Financial Formulas]] | |

| − | * | + | |

| + | * [[Documentation/How_Tos/Calc: Financial functions|Financial functions]] | ||

| + | |||

| + | * [[Documentation/How_Tos/Calc: Functions listed alphabetically|Functions listed alphabetically]] | ||

| + | * [[Documentation/How_Tos/Calc: Functions listed by category|Functions listed by category]]}} | ||

| + | [[Category: Documentation/Reference/Calc/Financial functions]] | ||

Latest revision as of 15:09, 30 January 2024

- Financial FunctionsDepreciation

- AMORDEGRCAMORLINCDBDDBSLNSYDVDBPayment Streams, Annuities, Loans

- CUMIPMTCUMIPMT_ADDCUMPRINCCUMPRINC ADDFVFVSCHEDULEIPMTIRRISPMTMIRRNPERNPVPMTPPMTPVRATERRIXIRRXNPVSecurities

-